Money, banking & insurance

A bank with a focus on saving

For a bank ING Direct (US) acts pretty weird. The Internet bank has no branches, no ATMs, no fees and no minimum deposits. It doesn't issue credit cards, doesn't have checking accounts and won't sell car loans to customers. It has a relatively small range of products and encourages customers to save rather than spend. Customers are also treated exactly the same no matter how much money they have. Last year the bank even ‘fired’ three and a half thousand of its customers because they called customer service too many times or asked the bank to bend its rules in one way or another. As a result ING Direct has costs 84% less than conventional banks in some areas.

Ref: Rebels With a Cause, and a Business Plan, New York Times (US) 2 January 2005. www.nytimes.com

Last of the big savers?

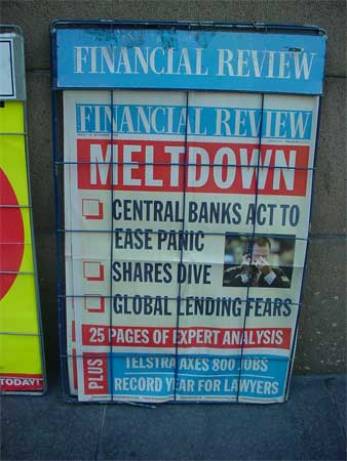

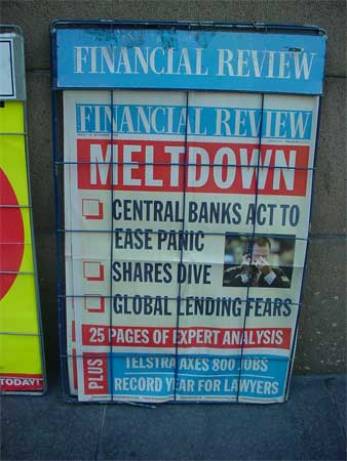

A report entitled Financing Your Future by the Skipton Building Society says that UK household debt will soar from 139% of total household income to 150% over the next decade. This means that total household debt will increase from GB £1 trillion to GB £1.6 trillion. Bizarrely this situation may result in what the report calls a 'savings renaissance' as consumers who are facing longer retirements move away from materialist lifestyles and downgrade everything from homes to holidays. Over in Australia household debt has grown by 16.8% over the past 12 months and total household debt now stands at AUD $ 714 billion.

Ref: Money Observer (UK), 28 October 2004. UK Household Debt To Soar To GBP 1.6 Trillion. http://www.moneyobserver.com

Equity release

The equity release market (where homeowners release some of the capital built up in their home) has traditionally worked by giving homeowners a lump sum payment against the value of their home. A new approach in the UK allows homeowners to withdraw this capital on a regular basis instead. So how long will it be until a bank or other financial institution gives homeowners a chequebook to write cheques out against the value of their home?

Ref: Financial Advisor (UK), 14 October 2004 - Calls to introduce drawn down flexibility products.

2020 vision

Research commissioned by Alliance & Leicester and The Future Foundation (UK) claims that by the year 2020 more customers will be using a mixture of phone and Internet banking and less people will be visiting branches. 80% of bank customers will use Internet banking facilities and 95% will use the telephone or the Internet. The study called ‘Banking 2020: Future Trends’ predicts that 58% of customers will still use a mixture of channels including branch visits.

Ref: The Future of Banking, Online Banking Review (Aus) December 2004/January 2005 http://www.onlinebankingreview.com.au

Flying the flag

We’ve written about the rise of tribalism and localisation before but here’s another example. Morgan Stanley in the UK has created a platinum credit card that’s available in four designs – the Union Jack, the St. George’s Cross, the St. Andrews’s Cross and the Welsh Dragon. It would appear that even banking is not immune to the fact that the more we become the same through globalisation the more we want to be recognised as being different.

Ref: www.morganstanleycard.co.uk

Cash incentives to get fit

The UKs second largest insurance company, Prudential, has borrowed an idea from South Africa and the US and created health insurance where the annual premium is related to how healthy you are. Points are awarded for healthy behaviour - like joining a gym, reducing your weight or giving up smoking. If your waistline decreases so do your payments. In South Africa, Discovery Health uses similar cash incentives while in the US Destiny Health (part of Discovery) has seen significant behavioural change take place once money is brought into the equation. Of course the idea is not entirely new. In Gloucestershire (UK) a local GP offers cash payments of GB £20 to his patients who give up smoking for four weeks. So could the idea of linking fitness to finance work in the public sector? In the UK the government already gives 16-year-olds money to stay on at school so it's not that much of a stretch to imagine governments paying citizens to stop smoking or eat more fruit. What else could the principle of cash for action be applied to?

Ref: Cash in on keeping fit, S. Crompton The Times (UK) 9 October 2004. http://www.timesonline.co.uk